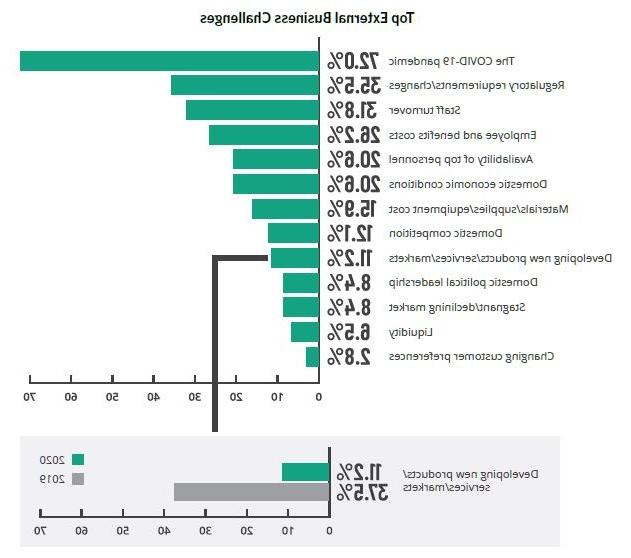

毫不奇怪,2020年新型冠状病毒肺炎的爆发对医疗机构构成了最大的挑战. 然而, 其他行业在哪里受到了国内经济条件的巨大挑战, 医疗保健组织在监管要求和员工流失率方面更加困难.

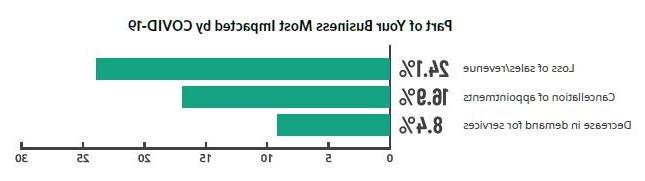

The negative effects of the pandemic were most acute among healthcare organizations—often related to loss of revenue and cancellation of appointments. 应对新冠肺炎疫情的广泛影响, 医疗保健组织正在重新考虑关键业务操作,如人员配置, 远程工作和办公室配置.

“导致了大流行, 医院和卫生系统的平均营业利润率很低, 他们的现金状况正在下降, 而非扩张国家的经济表现和流动性尤其黯淡. 感谢供应商的救济资金, 许多医院和卫生系统现在都有充足的现金, 尽管财务业绩持续下滑. 对许多人来说,救助基金是一剂至关重要的兴奋剂. 对于一些, 然而, they may have provided a false sense of security by masking underlying ongoing financial distress.”

-马克·阿姆斯特朗,医疗咨询公司股东

医疗保健组织对2020年大选的看法与其他行业类似. More healthcare respondents believe the election will have a negative impact on their business than believe it will have a positive effect, but almost a third of respondents believe the election will have no effect at all on their business.

当被问及经济前景时, 医疗行业是对美国经济最不乐观的行业. 然而,大多数医疗保健公司相信他们将在2021年实现收入增长.

医疗保健 organizations were more likely than many industries to increase their hiring over the past 12 months, 特别是在高增长群体中. 进入2021年,医疗保健组织高度重视收购和 留住人才, which they plan to address by hiring new employees and offering more flexible or remote work arrangements. Investing in technology is a high priority for healthcare organizations but is not quite as important as acquiring and retaining talent. 说到2021年的技术投资, 医疗保健组织最感兴趣的是业务智能和分析.

“医疗保健 organizations can see an immediate benefit in FTE productivity by implementing data acquisition and engineering. Pulling together large and disparate types of data from multiple sources into an organized format so that non-technical clinicians and hospital executives can utilize the information in decision making can have an immediate and significant impact on overall FTEs and their ability to focus on the more important tasks.”

- Brad Milner,医疗保健分析高级总监

2021年,医疗保健组织主要专注于销售现有产品. 大多数公司计划将现有产品销售到当前或新市场. 计划在2021年推出新产品的医疗机构减少了. 医疗保健组织计划在2021年增加资本支出. 这在高增长群体中尤为明显, with an average increase that is more than 15 percentage points higher than the no growth group. The most common targets for increased 资本支出 are acquiring new locations and upgrading IT services.

“The most common struggle for healthcare CFOs that we see is the challenge of consolidations for multi-entity, 多处组织. 医疗保健 CFOs must contend with the expansion of facilities and service lines across regions and states, 随着监管框架的发展,会计规则的性质不断变化, 强调通过有机的新项目或收购其他公司来发展业务, and increasing inter-relationships and inter-company activities between entities within the parent company. 使用单个组件解决整合的挑战, 基于云的金融系统工具可以推动您的医疗保健组织向前发展.”

- Stacy Schuettler,技术解决方案总裁